Schmidt & Schmidt provides extracts from the commercial register of France with a translation and an apostille.

The commercial registers of businesses and companies in France (Registres du commerce et des sociétés – RCS) are administered by the local commercial and civil courts. Nowadays there are about 4,500,000 companies presented on the French register, both active and inactive. Submitted data is verified before registration. The registers are available online, and extracts can be obtained in French and English. An extract is a kind of an “ID card” of a company, acting as a company’s main profile.

Extract from the French business register is an official document that contains publically available information about legal entities, partnerships, entrepreneurs, and permanent establishments of foreign companies based in France.

The register was created in 1919, and there are entries available for each year since then, both in hard copy and electronic form.

An extract from the French commercial registers can be used in order to:

- Obtain detailed information about potential business partners

- Negotiate foreign trade agreements

- Register legal entities with foreign participation

- Apply for French work visas

- File legal claims

An extract is provided in the form of a PDF-file in French or English. Original documents can be translated, sent by post, in a notarised or apostilled form.

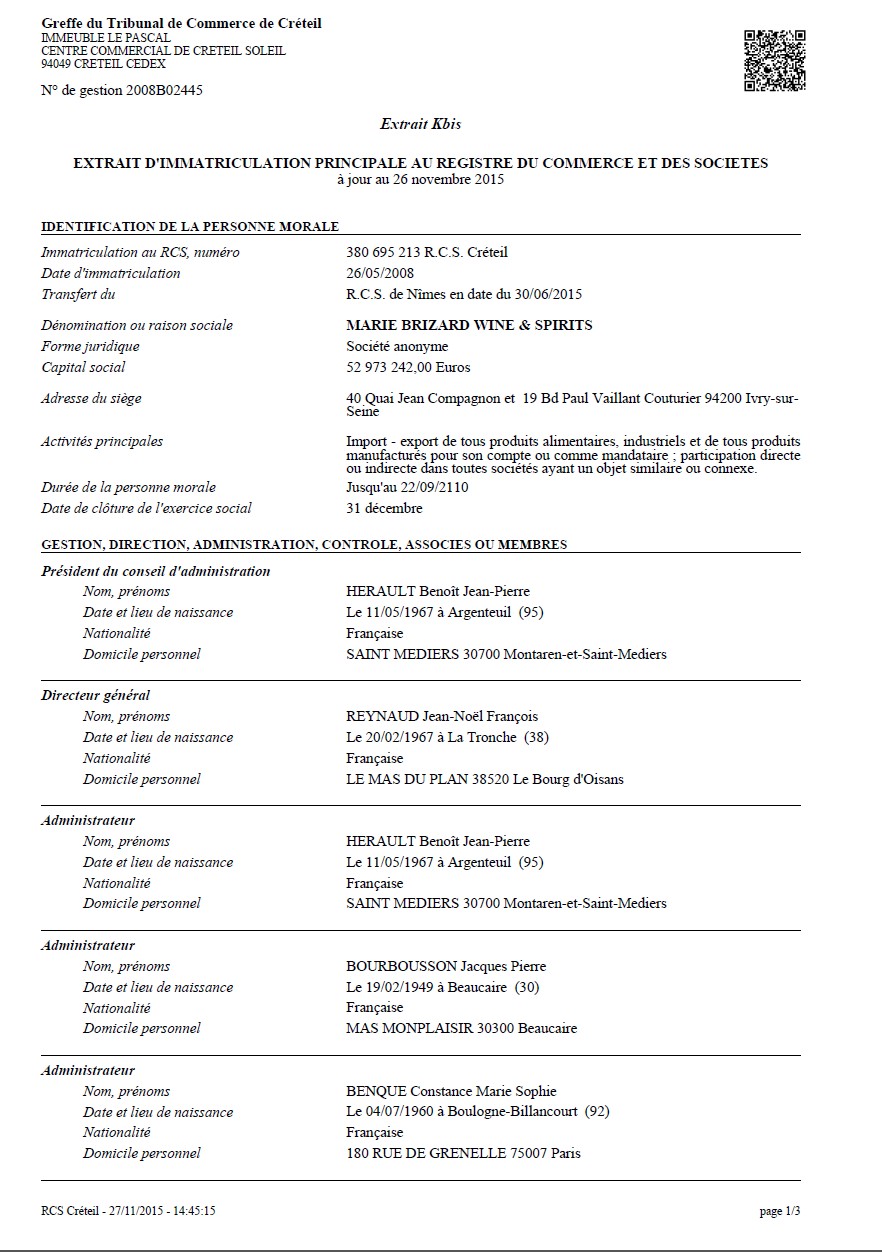

Current extract is an official document that contains up-to-date information about a company registered in France, including name, address, founding date, key management, registered capital, and bankruptcy or dissolution procedures. This is a main document that confirms the legal status of a company, similar to a Certificate of Registration.

Current extract from commercial register of France contains following information:

- Full legal name

- Type of business

- Legal address

- Contact information

- Main activity

- Share capital

- Board members

- Balance sheets and financial statements

NB: Information about some companies may be unavailable, or available for a fee.

Inquiries are processed from 30 minutes.

| Service | Price incl. German VAT 19% | Price excl. VAT |

|---|---|---|

| Price for an Electronic Extract | from 17,85 € | from 15,00 € |

| Price for an Extract with Apostille without international shipping | from 297,50 € | from 250,00 € |

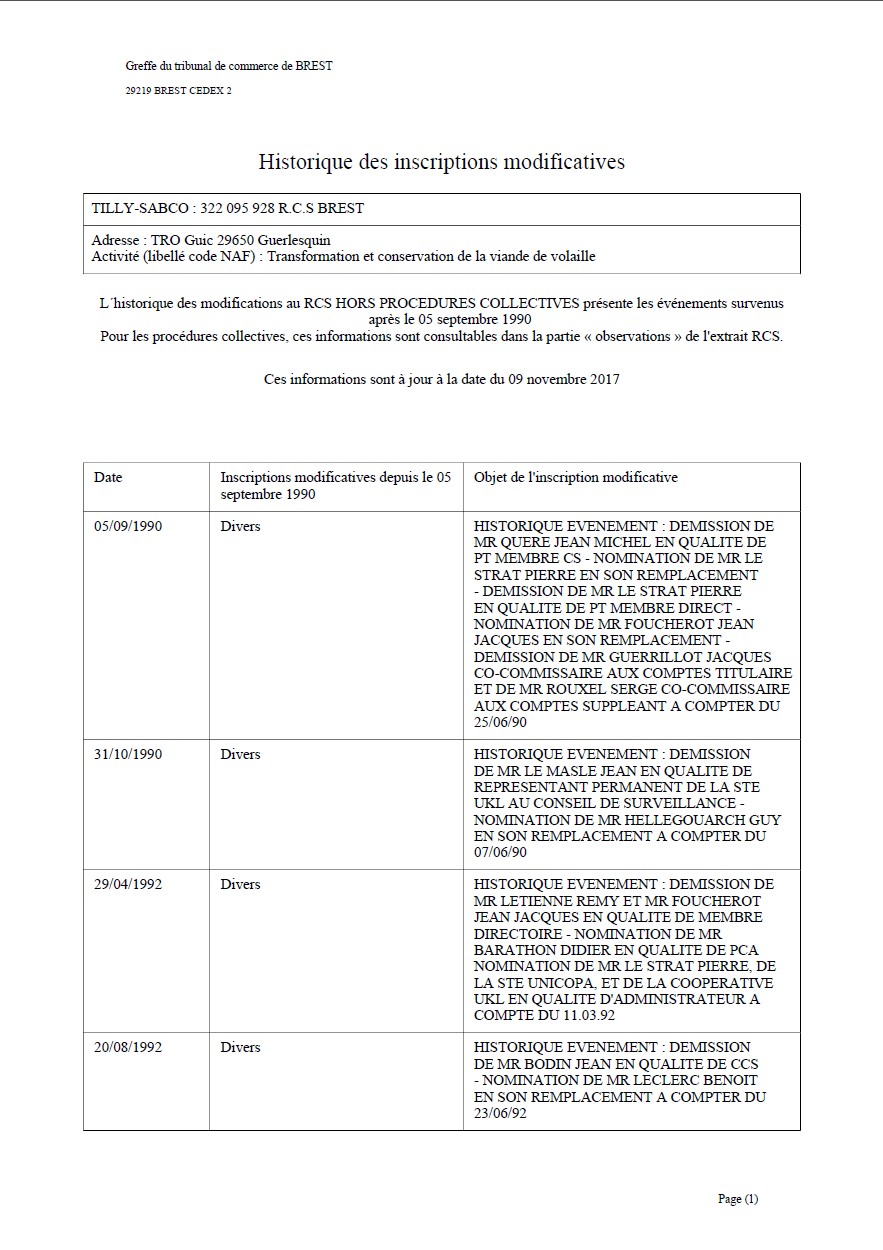

Historical extract contains information valid at a certain period of company’s history, as well as the record of changes, eg. name, address, type of business and management.

Inquiries are processed from 30 minutes.

| Service | Price incl. German VAT 19% | Price excl. VAT |

|---|---|---|

| Price for an Electronic Extract | from 17,85 € | from 15,00 € |

| Price for an Extract with Apostille without international shipping | from 297,50 € | from 250,00 € |

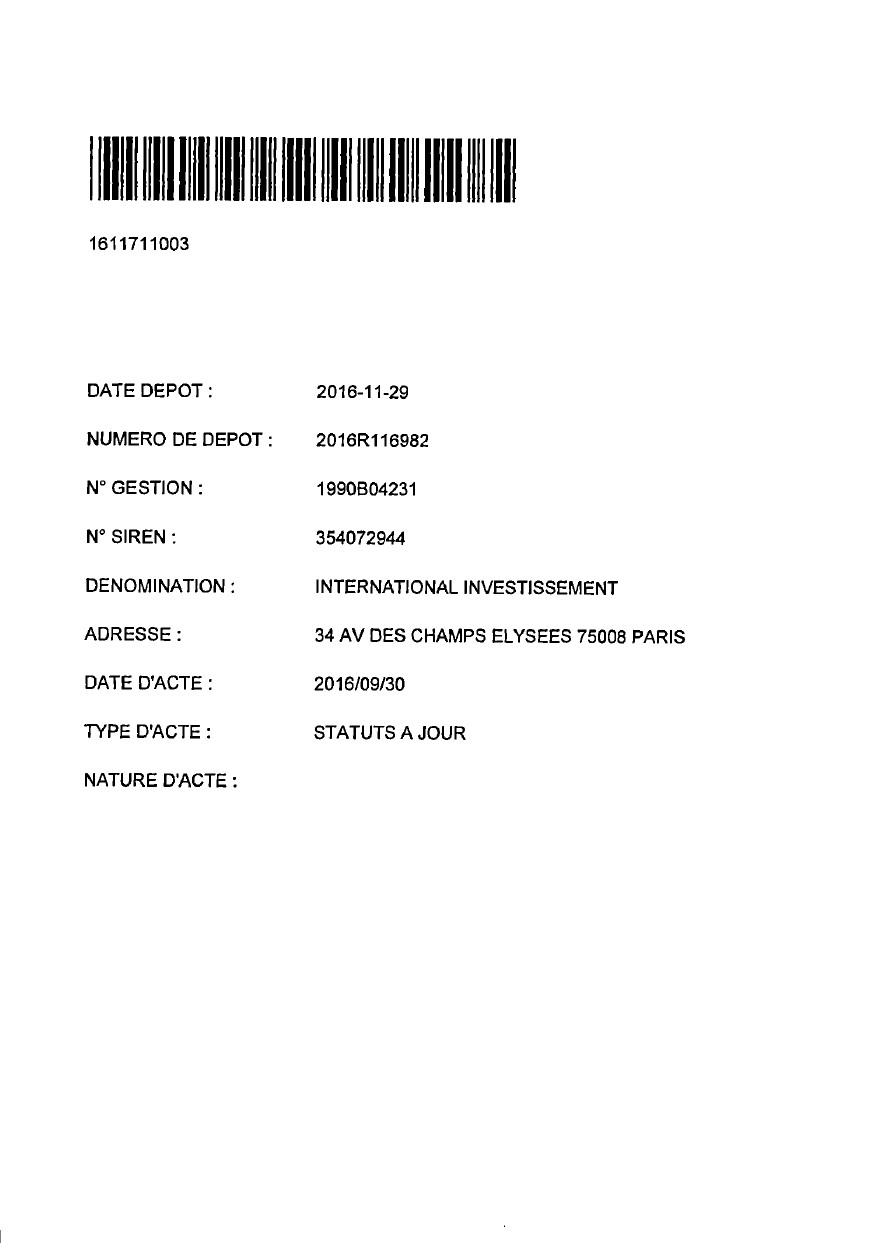

Corporate documents contain following information: company’s charter, memorandum of association, merger or division acts, and amendments to these documents.

| Service | Price incl. German VAT 19% | Price excl. VAT |

|---|---|---|

| Price for an Electronic Extract | from 17,85 € | from 15,00 € |

| Price for an Extract with Apostille without international shipping | from 297,50 € | from 250,00 € |

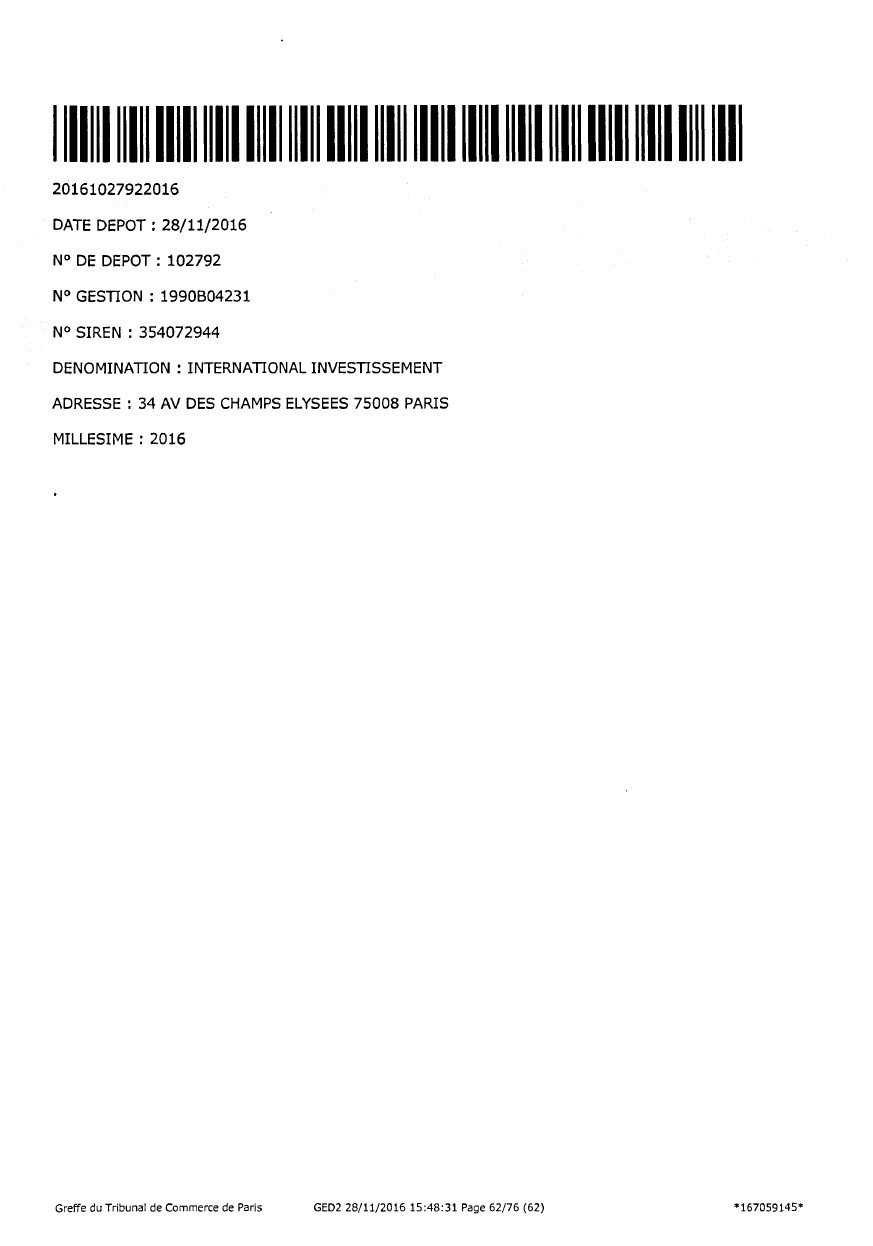

Annual financial statements are balance sheets, profits and losses, etc. Based on these records, it is possible to see the current financial state of a company.

Annual financial statements contain following information:

- Annual balance sheet

- Profits and losses

- Data on depreciation

- Fixed assets

- Payables and receivables

- Financial report of the CEO

- Profit distribution data

- Auditor’s reports

Depending on the company size, the volume of information can vary from 2 pages to hundreds.

| Service | Price incl. German VAT 19% | Price excl. VAT |

|---|---|---|

| Price for an Electronic Extract | from 17,85 € | from 15,00 € |

| Price for an Extract with Apostille without international shipping | from 297,50 € | from 250,00 € |

From commercial register of France you can get following documents:

- Debt report is a document that presents company’s debt reports, and data on rent and lease obligations.

- Certificate of Insolvency is confirmation of bankruptcy and dissolution procedures, or absence thereof.

| Service | Price incl. German VAT 19% | Price excl. VAT |

|---|---|---|

| Price for an Electronic Extract | from 17,85 € | from 15,00 € |

| Price for an Extract with Apostille without international shipping | from 297,50 € | from 250,00 € |

To get a required document, we will need the following information about a company:

- Full legal name

- Incomplete name with full legal address

- ID number

Main types of businesses in France

Legal entities:

Société anonyme (SA) – joint-stock company

Société par actions simplifiée (SAS) – “simplified” Joint-stock company (not involved in stock trading)

Société à responsabilité limitée (Sàrl) – limited liability company

Entreprise unipersonnelle à responsabilité limitée (EURL) – limited liability company with one founder

Société en Commandite par Actions (S.C.A.) – joint-stock partnership in commendam

Unincorporated:

Microentreprise – individual entrepreneur

Société civile (SC) – unlimited partnership

Société civile immobilière (SCI) – property management association

Société en nom collectif (SNC) – registered partnership

Société civile professionelle (SCP) – partnership of freelancers (people of “free professions”)

Société en commandite (SCS) – limited partnership

We provide extracts from the register in strict compliance with the legislation of the French Republic and the General Data Protection Regulation.

Inquiries are processed within one working day. Courier delivery of apostilled documents is paid separately by courier service tariffs.

You can order free preliminary availability check of required information on our website.

Beneficiaries register of France

The French State Register of Trusts has been in existence since 2013 and was created as part of a law to combat tax fraud and serious economic and financial crimes. The register contains information that the French tax authorities receive from trusts related to France.

Since 2011, all trusts in which at least one of the trusts, founders or beneficiaries is a tax resident of France, or which have assets located in France, must submit a special declaration to the French tax authorities, according to article 1649

AB of the French Tax Code. It is this data that is contained in the register, and it is this data that will soon be publicly available to anyone who wants to get acquainted with it.

Apostille for extracts from commercial register of France

France acceded to the The Hague Convention Abolishing the Requirement of Legalization for Foreign Public Documents on 25 November 1964.

Therefore, the documents issued in France are subject to a simplified apostilling procedure, thus the documents gain full legal value in Convention member states after certified translation.

Apostilling usually takes about two weeks.

In addition, you can order certified translation from French.